Trailing Total Returns Daily Monthly Quarterly Which Is Best

Trailing 12 months TTM is the term for the data from the past 12 consecutive months used for reporting financial figures. You will thus end up with a percentage gain or loss for the trailing returns on each day.

In simple words trailing returns is the calculating point-to-point returns and then annualizing them and hence are also called point to point returns.

. At the close of the last market. These are VERY different from the trailing total returns section 10-year return of 1779. I call this the good scenario to distinguish it.

A companys trailing 12 months represent its financial performance for a. Morningstar lists total returns using AUVs rather than net asset values NAVs because the AUV more accurately reflects the actual returns passed on to an investor. For example as of the most recent quarter ended March 31 Rydex Dynamic NASDAQ-100 2X Strategy posted a one-year trailing return of a whopping 3676 and more modest three- and five-year.

So after 10 years would it be worth 10000 x 10513 10 16492. As opposed to the traditional methods of publishing return statistics on a quarterly. The same statistical simulations indicate that there is a 25 chance you might get 25700 or even more of lifetime income per year.

This will result in true for the first day of quarter. Value today original valueoriginal value return100. By simply adding up those numbers we compute a total performance of but in fact YTD.

Trailing returns are the returns that measure the performance of a mutual fund for the past specific periods such as 1 yr 3 yr 5 yr or inception-to-date basis. The following Morningstar table shows the daily Trailing Total Return for GOF as of December 8 2021. Rolling return measures the funds performance across all timescales without bias.

In the following post we provide a more detailed explanation on how to precisely calculate YTD performance using monthly or quarterly returns. This looks like a pandas DataFrame. The statistic known as trailing twelve months or TTM shows the trailing total return of a fund for the previous 12 months.

Current and Historical Performance Performance for Health Care Select Sector SPDR Fund on Yahoo Finance. The total gain of 150 divided by the 10 starting share price produces a 15 percent trailing 12-month return. Trailing returns are those returns which can be calculated on the historical returns of mutual funds such as 1 year 3 years and 5 years or on the date basis.

The Return Date column displays the as of date for the returns listed in that view. 5612 1500 -227 equal 7546 for the quarter. You would also include any dividend that would be reinvested or expenses that would lower your return.

DfMSFT-US AAPL-US GE RF 1 monthly_total dfgroupbymonthproddropdate axiscolumns Giving us. SP 500 Copyright 2021 Currency is displayed in GBP. It does so by averaging returns over multiple instances of point-to-point returns for the desired period.

They are calculated every day. Pandas has build in functions for that which is the actual monthly return you are looking for. 1 2008 and 1010 on Jan.

AUV takes into account a. One way would be to see if the month has changed from the previous row to the current row. To put this in simple words trailing returns are calculated on the point to point return and then annualizing them hence this method is also known as point to point.

1 2007 the division will result in 101. 1401 3-Year Daily Total Return. A 10-year rolling return could highlight an investments best and worst decades in this form.

Rolling return measures not just one block of 3 or 5 or 10-year return but considers several such blocks of 3 or 5 or 10- year periods at various intervals. The best answers are voted up and rise to the top. In real life discrete returns are pretty much always used when it comes to reporting performance figures.

What is the calculation to get 7546. Trailing Total Returns BOTB. That indicates a beginning of the month.

With the advent of the internet and the widespread availability of data the mutual fund industry has begun publishing monthly updates on their funds trailing total returns. The following monthly returns. When you subtract 1 from the result you.

Monthly Total Returns GLD Category. For example if the price of gold was 1000 per ounce on Jan. To get compound returns we need to add 1 to each value and then use prod.

Trailing Returns Vs. AND MONTH A3MONTH A2MOD MONTH A331. MSFT-US AAPL-US GE RF month 201505 0008739 0946043 0070769 10.

Also the quarter can be detected month is 1 4 7 and 10 with the mod function. X2X1-1 has been used giving us a performance of 212 but the sum of individual daily returns is 231. Using trailing 12-month TTM returns.

Month-end returns use prices as of the last market close of the previous month and quarter-end returns use prices as of the last market close of the previous. Subtract one from the result of each day and multiply the outcome by 100. Expressed as a percentage this figure is calculated by taking the change in accumulation unit value AUV during the period and dividing by the starting AUV.

Finally the Overview section then shows a 10-year total return of 513 and a trailing 12-month yield of 052 and an expense ratio of 048. Whether or not this is 212 is up to the. SP 500 index data.

Thus 7-55 4100 40 Trailing Return. Daily returns use prices as of the close of business the previous day. Published Returns The mutual fund industry has.

If the fund started with a value of 5 and ended at 7 the change would be calculated as follows.

Time Series Forecasting Various Forecasting Techniques

Time Series Forecasting Various Forecasting Techniques

8 Charts On 2021 Market Performance Morningstar

Energy Was The S P 500 S Best Performing Sector In 2021 Can The Outperformance Continue The Motley Fool

Better Buy Nvidia Vs Advanced Micro Devices The Motley Fool

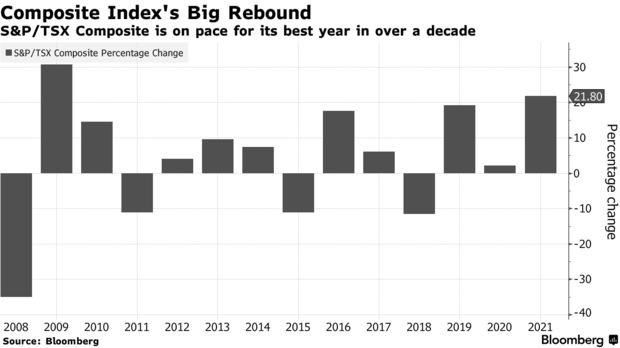

Canadian Stocks Close Out Best Year Since 2009 Led By Energy Bnn Bloomberg

The Best Strategies For Inflationary Times The Journal Of Portfolio Management

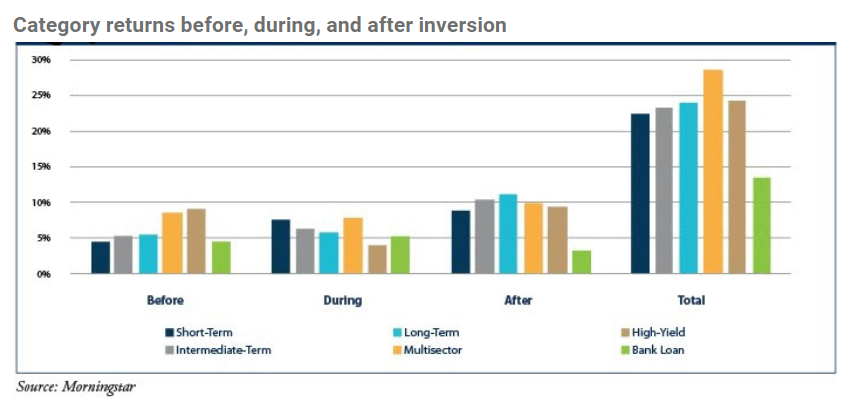

Inverted Yield Curve What Does It Mean For Bonds

Legal General Stock One Of The Best 6 5 Yielding Blue Chips Otcmkts Lggny Seeking Alpha

Best Stocks To Invest In Right Now 4 Cyclical Stocks For Your August 2021 Watchlist Nasdaq

Is Now A Good Time To Buy Stocks The Motley Fool

2 Unstoppable Stocks That Are On Sale Right Now The Motley Fool

3 Mistakes You Re Making With Month Over Month Growth Rates

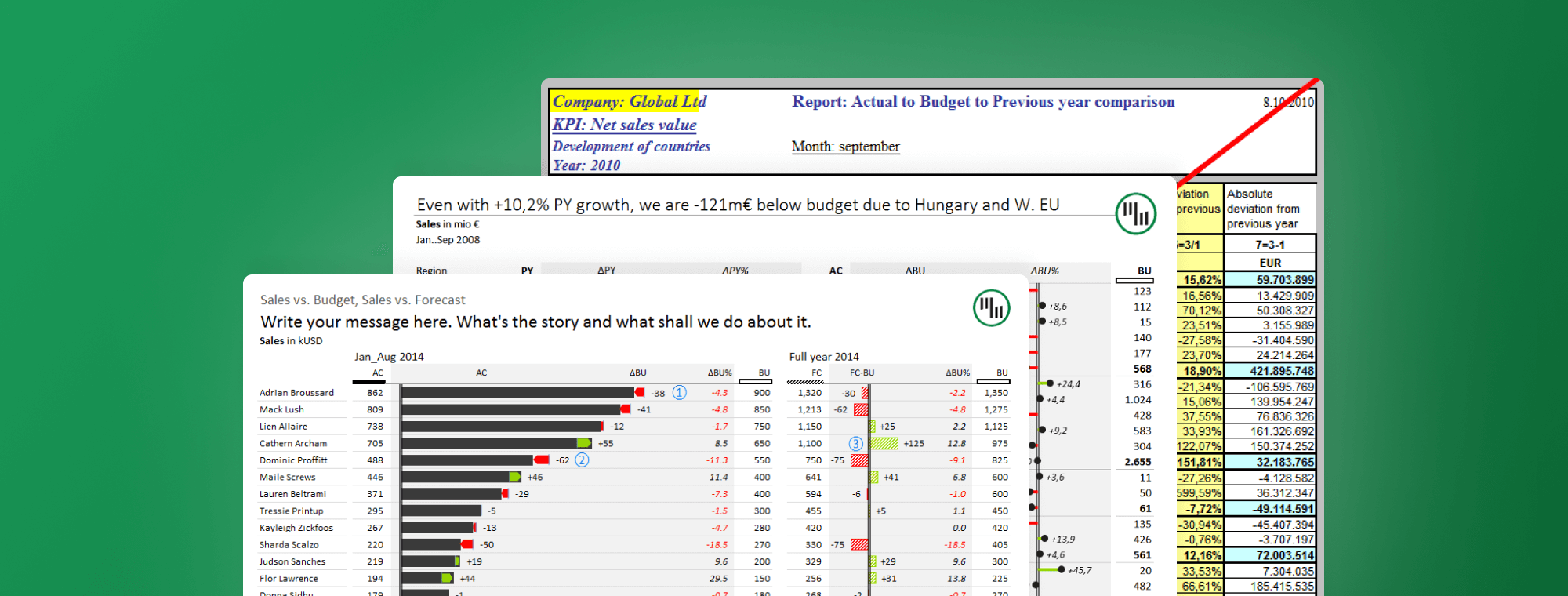

Variance Analysis Top 3 Ways To Report It In Excel

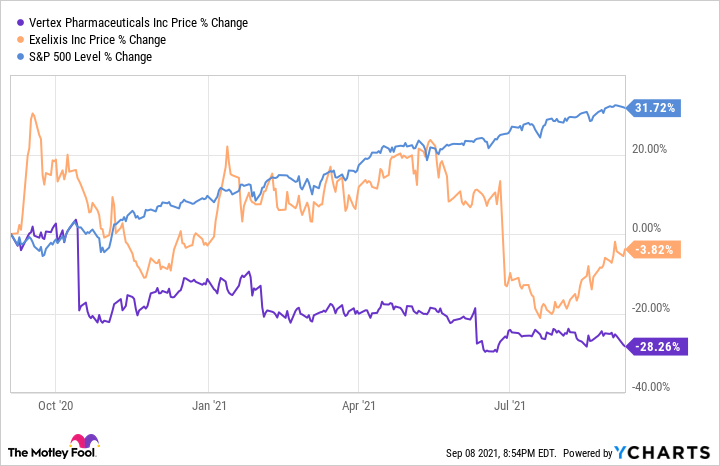

2 Top Biotech Stocks To Buy Right Now The Motley Fool

How We Got To Post Truth Fast Company Business Innovation There S Never Been So Much To Read And So Many Reader Social Data Social Media Social Marketing

Amazon Is Goldman S Top U S Internet Stock Pick For 2022 Bnn Bloomberg

:max_bytes(150000):strip_icc()/AdvancedCandlestickPatterns3-1db9fa747bff4181a5970961b42bde4d.png)

:max_bytes(150000):strip_icc()/AdvancedCandlestickPatterns1-f78d8e7eec924f638fcf49fab1fc90df.png)